Harvard’s recalibrated Economic Complexity Index – Australia’s rank rises but underlying challenges remain

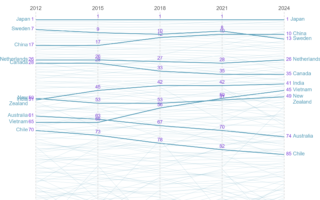

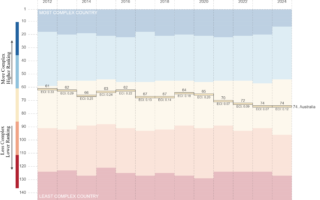

New data from Harvard’s Growth Lab’s Atlas of Economic Complexity shows Australia’s position in the global Economic Complexity Index (ECI) has moved from 105th to approximately 74th out of 145 countries assessed.

Harvard makes clear that the improvement is largely due to changes in how the index is calculated rather than a sudden transformation of Australia’s economic structure. These technical adjustments alter how countries are compared, realigning rankings across the world.

Harvard’s Growth Lab’s ECI ranks countries according to the diversity and complexity of what they produce and export. Economies with a broad mix of complex products tend to score higher and are more prosperous, while those focused on a narrow range of simpler goods score lower and face more limited growth opportunities – the latter being the case for Australia.

Put simply, Australia’s rise in ranking does not yet reflect a major structural shift in the complexity of its export base. While resources remain crucial to the national economy, Australia must focus on increasing its mid-tier manufacturing through value adding to raw commodities before exporting.

What The New ECI Ranking Really Means for Australia.

Australia still exports a narrow set of goods, with a heavy emphasis on resources and commodities that do not score highly under the index’s complexity measures.

- Australia ranks second lowest OECD nation just ahead of Chile. By comparison, New Zealand ranks a full 25 positions higher than Australia in the index (49) and Greece 26 positions higher at 48.

- Australia’s growth prospects remain low at 1.2%, placing its growth 123rd of 145 of monitored nations.

- Harvard’s qualitative assessment of Australia remains unchanged, stating: “Australia is less complex than expected for its income level… Compared to a decade prior, Australia’s economy has become less complex, worsening eight positions in the ECI ranking.”

Managing Director for the Advanced Manufacturing Growth Centre (AMGC), Dr Jens Goennemann said,

“While Australia’s rise in the updated Harvard Economic Complexity Index may look positive, it reflects changes in methodology rather than a sudden shift in our industrial capability.

“What it does highlight is our country’s untapped potential and serves as is a reminder that we must have policy settings that support complex manufacturing and invest in scaling our abundant small-to-medium sized manufacturers if we are to secure a stronger, more resilient and more complex economy for all Australians.”

“Over the past decade, AMGC in partnership with local manufacturers has demonstrated that when Australian industry is supported to innovate and commercialise smart ideas, we can create high-quality jobs, grow exports and build competitive, value-added products.” said Goennemann.

AMGC has built a national network of more than 4,400 manufacturers and industry partners, conducted approximately 5,000 on-site visits, delivered over 500 industry events, produced more than 20 major research reports and contributed to more than 100 government advisory sessions.

AMGC has facilitated more than 500 industry collaborations and co-invested in over 170 advanced manufacturing projects, helping create more than 4,300 jobs across Australia. These initiatives have committed over $137 million in combined industry and government investment to local manufacturing, generating an estimated $1.7 billion in additional national revenue – delivering a $25 return to the economy for every $1 of taxpayer funding entrusted to AMGC.

A link to the latest Harvard ECI rankings release can be found here: 2026 Harvard ECI Release

The full country profile for Australia can be found here: Australia ECI Profile