Harvard’s Economic Complexity ranking shows Australia’s luck is running out

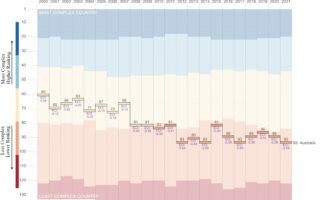

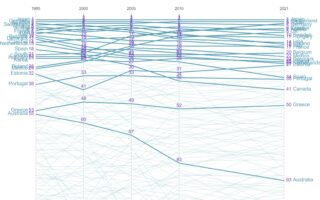

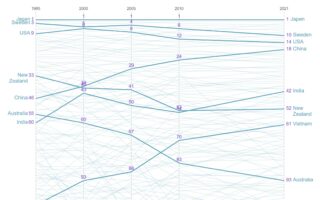

Australia’s overreliance on exporting items of low complexity has been laid bare in data released by the globally respected Harvard Kennedy School which reveals that Australia’s Economic Complexity Index (ECI) rating has plummeted to 93rd, down 12 positions in the past ten years.

The Harvard Index systematically ranks 133 countries by their ability to manufacture and export diverse and complex items and services and has been a global benchmark of a nation’s global impact since 1995, when Australia ranked 55 on the index.

The continued fall in ECI rankings now places Australia between Uganda and Pakistan in the bottom third of monitored nations for economic complexity. The poor ranking means Australia continues to hold the unenviable position of the lowest-ranked OECD country, despite the nation’s high level of wealth.

The ECI brings into sharp focus the imperative for Australia to boost its economic complexity by adding value to its natural resources and commercialising world-leading ideas through making more complex things, which is also called manufacturing.

“Australia’s continued fall in ECI rankings is completely predictable. If this is to change, then we must focus on transitioning away from a luck-based economy to becoming smarter if we are to protect our high standards of living and prosperity into the future,” said the Managing Director of the Advanced Manufacturing Growth Centre (AMGC) Dr Jens Goennemann.

“There is no excuse for Australia’s poor ECI ranking and our continued decline shows Australia’s luck is on borrowed time. We have the human capital, abundant natural resources, and capable yet subscale manufacturers. The missing piece of the puzzle is long-term focus through continuity of programs and investment for industry – which other countries do well,

“We must invest now while the times are good to ensure that we have a robust manufacturing industry making the high value, highly complex items the world needs to whether future bad times and to give our children meaningful and resilient jobs.” Said Goennemann.

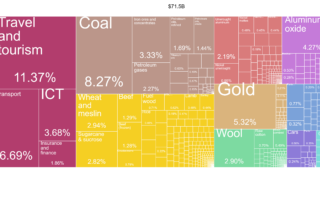

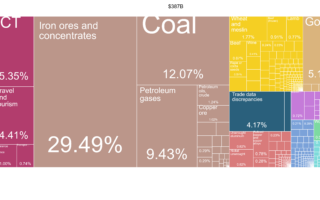

The report states that “Australia has seen a troubling pattern of export growth, with the largest contribution to export growth coming from low and moderate complexity products, particularly Ores, slag and ash and Mineral fuels, oils and waxes products.”

“The future looks quite bleak unless serious long-term strategy and capital commitments are made to turn the tide of Australia’s continued complexity decline. It is also incumbent on Australian industry to band together, collaborate and focus its efforts beyond the Australian domestic market if we want to safeguard our future prosperity and lift our global influence.” Said Goennemann.

Since its inception in 2015, the Advanced Manufacturing Growth Centre (AMGC) has advocated and demonstrated the potential of Australia to grow the complexity of its exports through co-investing in local manufacturing excellence.

More recently, AMGC has advocated that the Federal Government’s forthcoming National Reconstruction Fund (NRF) and Industry Growth Program (IGP) should feature initiatives to assist Australia’s 40,000 small-to-medium-sized manufacturers commercialise their ideas and scale, generating jobs and prosperity along the way.

AMGC has successfully demonstrated how to build capability and scale through its well-managed $57 million co-investments targeted directly to Australia’s manufacturing SME’s . AMGC’s co-investments of 141 projects have committed a dedicated research partner to commercialise research findings by helping to resolve real-world manufacturing challenges and lifting product complexity along the way. These projects are expected to generate over 4,200 new highly skilled, and well-paid roles, and on completion will return $1.6 billion to the economy.

To read Harvard’s ECI report in full, visit – https://atlas.cid.harvard.edu/countries/14