Manufacturing is the answer to improving Australia’s falling complexity ranking

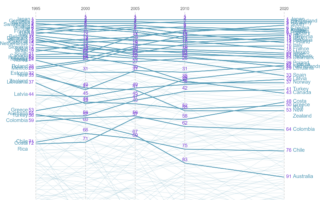

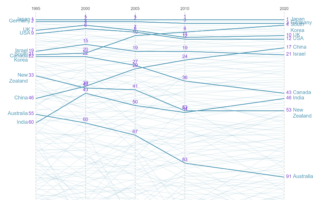

The latest data released by globally respected Harvard Business School reveals that Australia’s Economic Complexity Index (ECI) rating has slid to 91st, down eight positions in ten years. The Harvard index systematically ranks 133 countries by their ability to manufacture and export diverse and complex things and has been a global benchmark of a nation’s global impact since 1995, when Australia ranked 55 on the index.[1]

The result places Australia in the bottom third of monitored nations for complexity, between Kenya and Namibia, and also means Australia is the lowest ranked OECD country despite its high level of wealth.

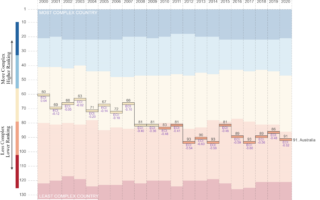

The Index brings into sharp focus Australia’s economic reliance on exporting items of low complexity in the form of commodities, and highlights the immense opportunity the nation has to improve the complexity of the items it exports, by adding value to its abundant natural resources or making more complex items in areas of relative strength.

The report states that “Australia is less complex than expected for its income level” and goes on to say that “Australia has seen a troubling pattern of export growth, with the largest contribution to export growth coming from low and moderate complexity products, particularly Ores, slag and ash and ICT products.”

Since its inception in 2016, the Advanced Manufacturing Growth Centre (AMGC) has advocated and demonstrated the potential of Australia to grow the complexity of its exports through co-investing in local manufacturing excellence.

AMGC’s Managing Director Dr. Jens Goennemann said “The latest ECI rankings are a damning reflection of Australia’s reliance on raw commodities trade – or luck. If these ECI results were reflected in the elite sporting world, we would be mortified!,

“Why is it that we accept such a poor result in our global complexity ratings when it is directly tied to our future prosperity? At some point the ‘Lucky Country’ will run out of luck; now is the time for us to act and begin to increase the complexity of the things we manufacture and export,” said Goennemann.

The Harvard report goes on to state that, “Australia has not yet started the traditional process of structural transformation. A key source of economic growth, this process reallocates economic activity from low to high productivity sectors. It broadly moves activities out of agriculture into textiles, followed by electronics and/or machinery manufacturing.”

Raising the nation’s manufacturing profile requires long-term policy and co-investment from the government as well as private sources. Multiple micro-investments matched dollar-for-dollar by industry participants incentivises Australia’s largely SME-based manufacturing companies to innovate and scale. Investment, in a variety of forms, delivers the necessary means to up-skill the existing workforce, hire new employees, advance much-needed technology, and deliver commercially successful, high-value products to domestic and international markets.

To meet this national challenge, AMGC has successfully managed over $57 million in co-investments directly to Australia’s manufacturing industry and encouraged manufacturers to scale and export. AMGC’s targeted co-investments into 141 projects – all with a dedicated research partner to help resolve specific challenges and lift product complexity – are expected to generate 4,000 new, highly skilled, and well-paid roles and on completion will return $1.6 billion to the economy

To read Harvard’s ECI report in full, visit – https://atlas.cid.harvard.edu/countries/14

FURTHER INFORMATION

- To view AMGC’s co-invested projects portfolio – https://www.amgc.org.au/projects/

- To read more of AMGC’s research reports – amgc.org.au/resources/

- To join, explore and learn about manufacturing and Industry 4.0 visit AMGC’s Manufacturing Academy – amgc.org.au/manufacturing-academy/

- To access media resources, visit – amgc.org.au/newsroom/

- To explore how AMGC, in conjunction with the Department of Industry, Science, Energy and Resources, along with Australia’s manufacturing industry has responded to COVID-19 visit – amgc.org.au/covid-19-manufacturer-response/

[1] https://atlas.cid.harvard.edu/countries/14